Most field service companies have accounting and field service management software running behind the scenes. Each make your company more efficient than using paper, but double entry and time delays occur when these two systems don’t work together.

That’s why you need field service software for QuickBooks that has a real-time QuickBooks integration.

In this blog, we’ll cover 5 common situations home service companies encounter. For each one, we’ll discuss how each QuickBooks integration would impact your business.

What is a QuickBooks Integration?

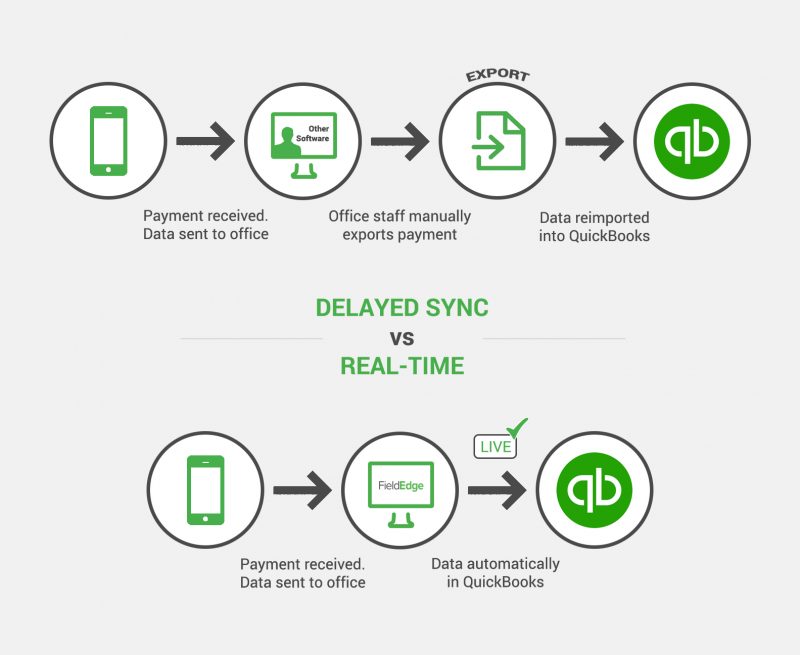

Not all QuickBooks integrations are created equal. There are two main types – delayed sync and real-time. Many field service management software companies claim they have a real-time integration, but often you’ve been sold a delayed sync integration.

Both integrations start the same way. A technician finishes a job and the work order information is sent from the mobile app to the office.

With a delayed sync integration, a member of your office staff will need to either manually push a button or set up a sync schedule to send that information from your field service management software to QuickBooks. This may not seem like a big deal. However, every moment your field service management software and Quickbooks aren’t sync’d leaves you open to major headaches.

With a real-time integration, your office staff doesn’t need to worry about pushing any buttons or waiting for data to match up across systems. Once the data is in your field service management software, it’s in QuickBooks too.

Click here to learn more about FieldEdge’s QuickBooks dispatch software integration

You may be asking yourself why not all field service management software have a real-time integration with QuickBooks. The simple answer? A real-time integration requires deep expertise in understanding your business and accounting practices, plus it’s cheaper and faster to develop a delayed sync integration. Unfortunately, cost savings for those software companies comes at your service company’s expense.

Now, let’s cover how these two types of QuickBooks integrations address five common scenarios service companies face and see if your integration is killing productivity.

1) End of day, month, quarter entries

It’s the end of the quarter. A payment comes in from a new customer and needs to be deposited immediately otherwise your final numbers for the quarter won’t be accurate.

Delayed Sync Integration: The customer isn’t in QuickBooks yet, so they are manually added. When your field service management software finally syncs with QuickBooks, you get an error because the records don’t match or it could create a duplicate record. This means you end up spending your valuable time fixing the issue after hours.

Real-time Integration: Enter customer information once and view the deposited payment in QuickBooks in real-time. Eliminating double entry saves your staff time they can now spend on other critical tasks within the business.

2) Invoice Mistakes

Upon submitting an invoice, you notice you added the wrong part and it needs to be corrected to avoid overcharging the customer. You have a lot on your plate so the mistake needs to be fixed now, otherwise you may forget to do it later.

Delayed Sync Integration: You will need to correct the invoice in both QuickBooks and your field service management software because the sync has already taken place. If you don’t fix the problem now, you’ll end up with an angry customer and incorrect financials.

You’ll also need to spend more time coordinating with your team to fix the issue in QuickBooks and your field service management software.

An even worse situation would be if you only fixed the error in QuickBooks. Now you run the risk of your office staff calling a customer claiming they didn’t pay the whole invoice.

Real-time Integration: Easily edit the part and line item amount within your field service management software and it’s immediately fixed in QuickBooks too, even after submitting the invoice! This means saved time in the office and peace of mind knowing your field service management software and QuickBooks always balance.

You also benefit from happy customers who don’t have to deal with being invoiced twice or billed the wrong amount.

3) Payment in the Field

You’re a technician for your company and a customer pays on site. They pay half of the balance now and send in a check later to complete the payment.

Delayed Sync Integration: You submit the first half of the payment, but when the second half comes in, you must enter it directly into QuickBooks. Your other option is to enter it into your field service management software and then go into QuickBooks later to match the payment to the invoice.

If they aren’t matched, you suffer from an inaccurate general ledger because amounts aren’t reflected correctly. This could also cause confusion because if the 2nd payment isn’t associated with the specific work order, you could end up invoicing the customer again for that balance even though they already paid you.

Real-time Integration: Technicians can collect payment in the field. The payment will automatically be allocated to the correct invoice in QuickBooks. You can see your business stats in real-time, all the time. No more time wasted waiting around for payment.

4) Long-term Jobs with Overlapping Pay Periods

![]()

It’s the beginning of the month. Your technicians are in the middle of a commercial HVAC job that will take three days to complete, but the job overlaps from last month to this month. As you’re initiating payroll, you find yourself trying to confirm timesheets, but since the job occurs during two different pay periods and the work order isn’t completed yet, you’re having trouble paying your guys the correct amounts.

Delayed Sync Integration: Unfortunately QuickBooks won’t receive your technicians’ time associated with the work order until that work order is complete. You end up wasting time making multiple work orders for that job in QuickBooks to be able to pay your employees for the time put in last month. In the meantime, your guys aren’t getting paid accurately.

Real-time Integration: Even though the job is still open, you’re able to pay your technicians the time they’ve already worked because the timesheets automatically posted to QuickBooks. This means you have happy, compensated employees which leads to growth and improved business operations.

5) Inventory Tracking

It’s summertime and business is booming. One of your technicians just finished replacing a capacitor and is headed to a similar job for his next work order. You need to know what has been used so you can restock those parts.

Delayed Sync Integration: QuickBooks shows the technician’s truck has enough inventory, but your technician calls in saying he doesn’t have a part for the job he just arrived at. The inventory count was not synced to QuickBooks yet.

Now your technician can’t complete the job and another appointment needs to be made with the customer for when the part comes in. The time your tech must take to visit that customer again is time he or she could have spent on another revenue generating job.

Real-time Integration: When a work order is submitted, items used are automatically deducted from the parts count in your field service management software and QuickBooks. You have insight into your inventory, which means you know exactly when and what to restock while also reducing windshield time and revisits for your technicians.

Side-by-Side QuickBooks Integration Comparison

The five scenarios above could happen to your field service company at any time. Maybe one of them already has! The different integrations result in very different outcomes, but it’s clear one integration handles the situation better.

Let’s review why a real-time integration is the ideal choice. Want a true real-time QuickBooks integration that does everything we detailed above? Then talk to us! FieldEdge was the first company back in 1998 to invent a true integration between QuickBooks and a field service management software. Click below to speak to one of our experts!